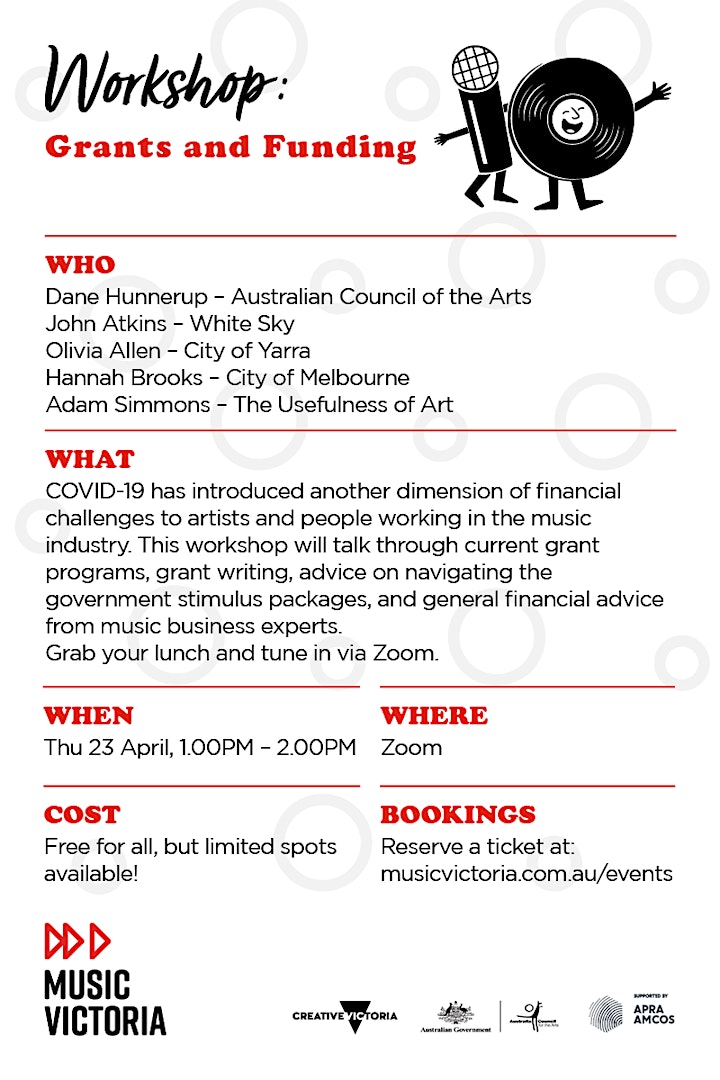

COVID-19 has introduced another dimension of financial challenges to artists and people working in the music industry. This workshop will talk through current grant programs, grant writing, advice on navigating the government stimulus packages, and general financial advice from music business experts.

You will hear from:

Dane Hunnerup - Australia Council for the Arts

John Atkins - White Sky

Olivia Allen - City of Yarra

Hannah Brooks - City of Melbourne

Adam Simmons - The Usefulness of Art

Grab your lunch and tune in via Zoom. Please RSVP, spots are limited.