As we approach the end of the financial year, our thoughts turn to taxes. The friendly folk over at White Sky Music, Australia’s biggest music business management and bookkeeping company, have put together these notes to help artists get their business started and keep the books. There’s also a handy list of what you can claim as a musician or music business.

Getting Started

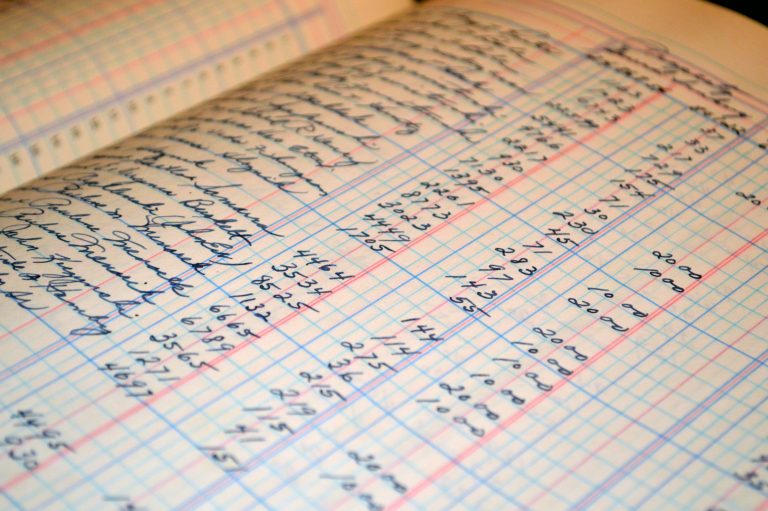

Bookkeeping can seem like a daunting prospect for any young artist starting out. But once you get your head around it and set up some simple procedures, it’s really not as scary as it seems.

In a nutshell, bookkeeping is just a word used to describe keeping track of all your business incoming and outgoing transactions.

Thinking about your musical career as a small business is the first step to getting started. Here are some tips to help you on your way.

Setting up a Business Structure and ABN (Australian Business Number)

Once you’ve decided you’re going to treat your artistic endeavour as a business you will need to set up the appropriate entity structure. This may be in the form of a Sole Trader, Partnership, Company or a Trust structure.

It’s a good idea to engage a good music industry based Tax Agent to advise you which entity is best for you.

If you’re planning to set up a basic Sole Trader (if there’s only one of you) or Partnership (if there’s a group of you) you can register for an ABN directly via the website www.abr.gov.au

Register your Business Name

The next step is to register your business name so you can legally trade under that name as well as open a business bank account. It costs $80 for three years and can be done at this website: www.asic.gov.au/business-names

NOTE: If you’re a Sole Trader and your business name is your actual name, you don’t need to register it.

Open a Business Bank Account

Once you have your ABN and you’ve Business Name certificate, you can open a business bank account.

Think about what banking facilities you might need, such as debit cards, credit cards or cheque books and speak to your bank about how to go about setting them up.

It’s really important that you keep your ‘business money’ separate from your ‘personal money’ so you can more easily keep track of it.

Bookkeeping Tips

It’s important to set up procedures and rules within the band/group, or even just for yourself, so keeping track of things is clear and easy.

- Keep it simple

Don’t over complicate your systems; just remember the basic principle that it’s just about keeping track of income and expenses. Your business manager, bookkeeper or accountant can deal with the complicated stuff as long as you’ve kept a record of what income you’ve received and what money you’ve paid out.

- Keep receipts for everything

This is the classic bookkeeper catch-cry and it’s as true today as it ever was. The good news is, modern technology is making this job easier.

As long as your images are totally clear, it’s fine to just keep a scan or digital photo of your receipts. There are Smart Phone apps that enable you to upload them to a cloud drive or direct to your accounting software.

Below is a list of things you may be able to claim, but when in doubt it’s better to keep the receipt anyway and ask your Tax Agent later.

- Don’t pay anyone without an invoice

It’s a good habit to remember to always make sure you have an invoice before you pay any crew or contractors. It’s a lot easier to ask for the invoice before you’ve paid them then to chase them up later.

- Keep on top of it regularly

It’s great to set up processes and systems, but if you don’t stay on top of things regularly things can quickly fall behind and become a headache. Try to look at your spreadsheets and file our receipts and invoices at least weekly.

- Centralize the control of the money

If you’re a band, or a group of any kind, it’s a good idea to place one person in charge of all the money stuff. This makes it easier for everyone.

- Separate your business money from your personal money

Make sure you use the business account as often as possible and keep as many of your business transactions running through your business account as possible. This will make doing your books a lot easier as you’ll have your bank statements to refer to if you’re every unsure of who or what’s been paid.

Typical Expenses Artists, Bands, DJs can claim

Live Performance Expenses:

General Expenses:

Admin Expenses:

Prepared by White Sky Music